Operations

Key Growth Plays In Chad

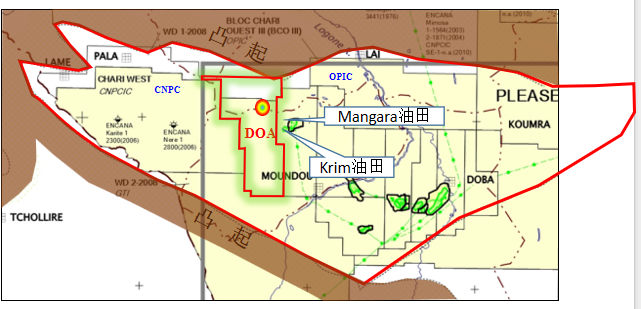

DOA Block

DOA Oilfield: World-Class High-Potential Oil and Gas Asset

The DOA Oilfield is located in the core area of Chad’s Doba Basin, a globally recognized oil-rich region adjacent to several large producing oilfields. However, DOA remains underdeveloped, possessing extremely high resource value and commercial potential.

1️⃣ Exclusive Development Rights

JH Energy holds 100% working interest in the DOA oilfield through a Production Sharing Agreement (PSC) signed with the Chad government, ensuring long-term stable priority extraction rights and management authority. The total area spans 2,035 square kilometers, covering multiple high-yielding oil layers, with fully autonomous resource development control.

2️⃣ Strategic Location

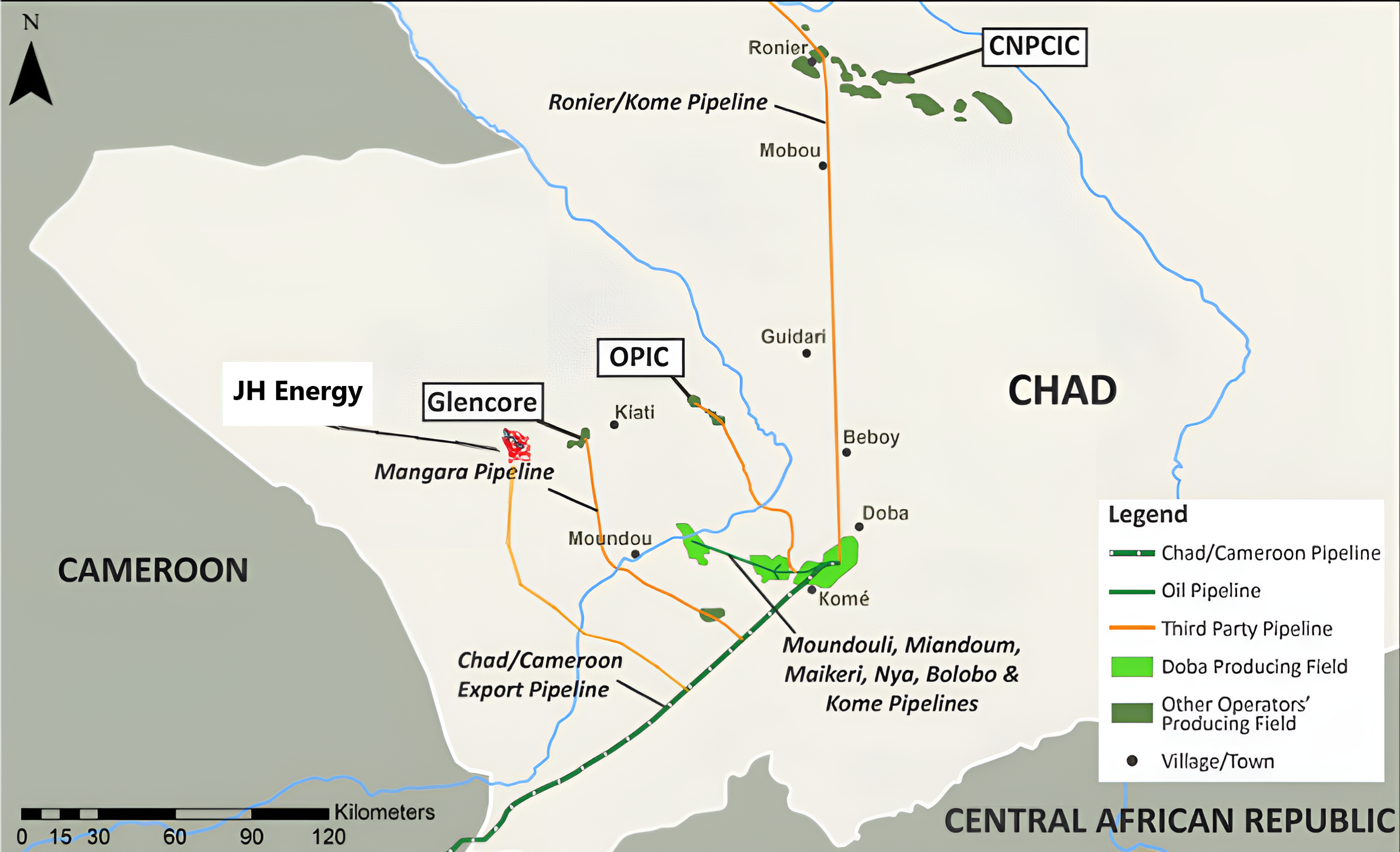

Located in Chad’s most important oil production area, adjacent to major oilfields operated by CNPC, ExxonMobil, Glencore and others, providing significant geographic competitive advantages. Direct connection to the Chad-Cameroon pipeline allows convenient export to the Kribi Terminal, reducing export costs and increasing profit margins. Existing infrastructure support reduces upfront development investment, enabling JH Energy to accelerate cash flow returns compared to other undeveloped oilfields.

3️⃣ Resource Potential

Proven recoverable reserves: 750 million barrels. High-value crude oil quality:

API 31-41°, classified as low-sulfur (0.12%) light crude oil, commanding premium prices in international markets.

4️⃣ Infrastructure Advantage

The region benefits from established infrastructure, including:

Chad-Cameroon pipeline (operated by ExxonMobil), connecting to Kribi Port, supporting direct crude oil export.

Regional oilfield pipeline network interconnection, enabling operational synergies with CNPC and Glencore facilities, enhancing logistics efficiency. Existing facilities available for utilization significantly reduce DOA oilfield development costs, providing economic advantages compared to completely new projects.

5️⃣ Peak Production Forecast

The DOA oilfield is expected to achieve peak daily production of 225,000 barrels of oil equivalent (boe/d) after implementing advanced horizontal drilling, smart completion technology, and Enhanced Oil Recovery (EOR) methods. Through nano gas-liquid mixed EOR technology, the ultimate recovery factor (RF) can be increased to 47% (industry average 35%), extending the stable production cycle to 25+ years.

6️⃣ Asset Valuation & Market Value

At a market oil price of $70 per barrel, the DOA oilfield’s theoretical resource value exceeds $50 billion.

Industry-Based Valuation: Using global benchmarks for African oilfields’ EV/1P (Enterprise Value/Proven Reserves), the DOA oilfield’s estimated market valuation is between $9-15 billion.

Future Upside Potential: With the implementation of AI smart oilfield technology and EOR methods, recovery rates can further improve, increasing valuation.

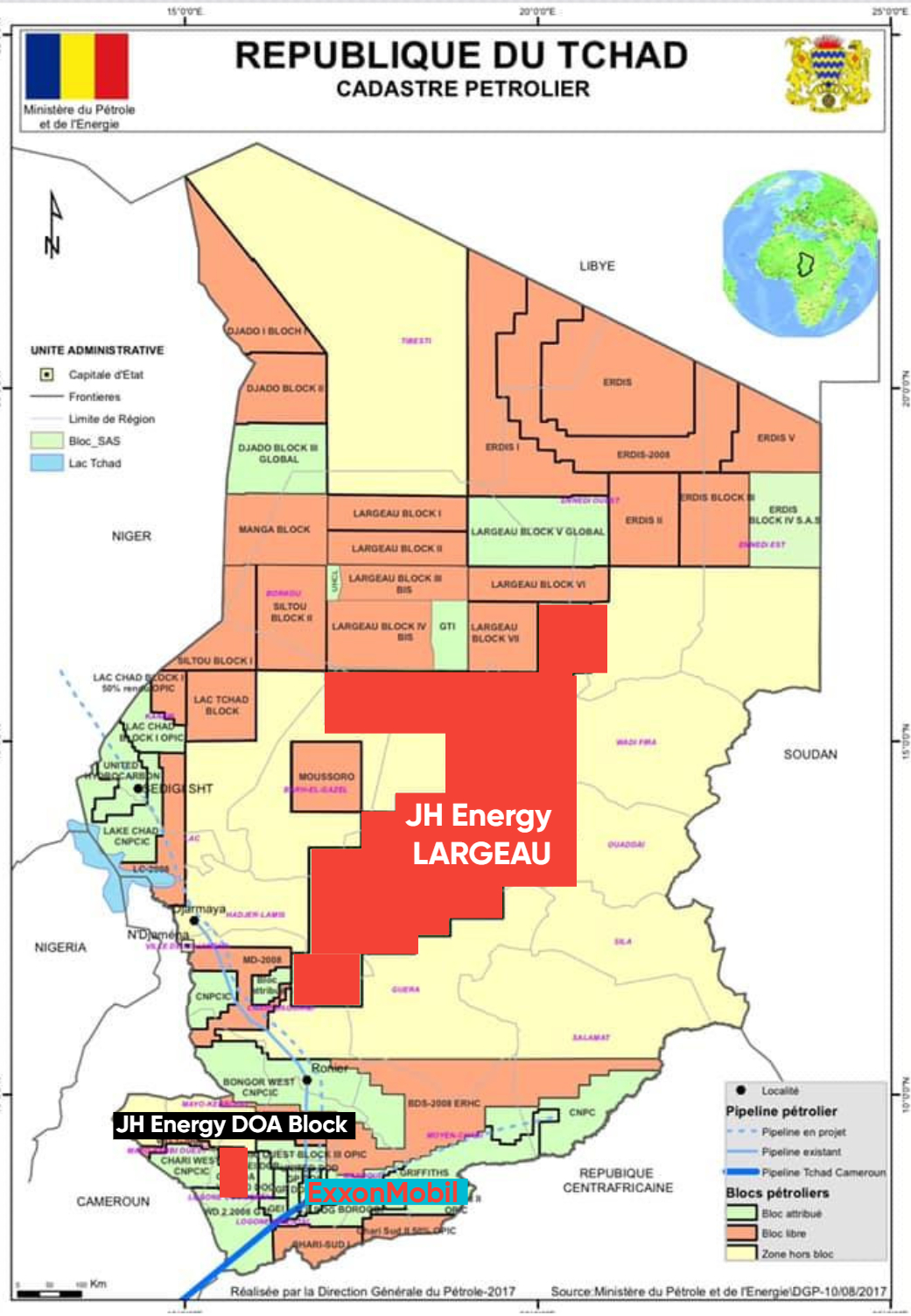

LARGEAU Block

Location: Central Chad, 142,000 square kilometers.

Reserves: Proven reserves of 4800 million barrels of oil.

Current Operations: Exploration activities are currently ongoing, with production expected to begin by 2029.

Production Forecast: Largeau block is projected to contribute an additional 15% to JH’s overall production once operations commence.