Insights

How Long Will We Need Oil?

Oil and natural gas will continue to play a significant role in the global energy mix for decades to come, despite the increasing share of renewable energy. Many experts predict that oil demand will persist until at least around 2050, even against the backdrop of energy transition.

The long-term demand for oil is influenced by several factors:

- Pace of Energy Transition – The shift toward renewable energy is underway, but progresses at different speeds globally

- Growth in Emerging Markets – Economic growth in developing countries may increase energy demand

- Technological Advancements – Including electric vehicle adoption and energy storage solutions

- Policy and Climate Change Commitments – Government policies will significantly impact oil consumption

- Continued Use of Oil as Feedstock – Beyond fuel, oil is used for plastics, pharmaceuticals, and many other products

Even as the energy mix diversifies, certain uses of oil in chemical products, aviation fuel, and heavy industry will be more difficult to replace and may persist longer. Each country’s transition path toward a sustainable energy future will vary depending on its existing infrastructure, resource endowments, and stage of economic development.

Will Demand Continue To Grow Strongly Through 2050?

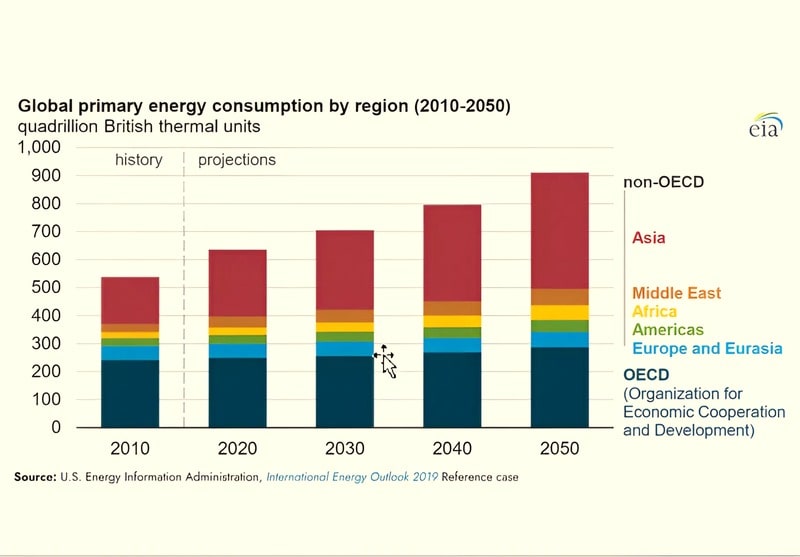

Global Energy Outlook: Strong Demand Growth Through 2050

The U.S. Energy Information Administration (EIA) forecasts that global energy consumption will increase by nearly 50% by 2050, rising from 600 quadrillion British thermal units (Btu) in 2018 to approximately 900 quadrillion Btu. This substantial growth is primarily driven by non-OECD countries, which are projected to increase their energy consumption by 70% during this period, compared to just 15% growth in OECD nations.

Oil will continue to play a crucial role in this energy landscape. Major forecasting organizations project global oil demand will reach approximately 103-106 million barrels per day by 2030, up from about 100 million barrels per day in pre-pandemic levels. OPEC’s outlook is even more bullish, forecasting demand to reach 108.6 million barrels per day by 2030, driven primarily by transportation and petrochemical sectors in emerging markets.

Asia will account for nearly 45% of global energy consumption by 2050, with China and India alone representing approximately 28% of the world’s energy use. Industrial energy consumption is expected to increase by 30%, reaching 315 quadrillion Btu by 2050, while transportation energy demand is projected to grow by 40% to 175 quadrillion Btu.

Despite the accelerating energy transition and increased adoption of electric vehicles in developed economies, the growth in overall transportation, aviation, and shipping in developing regions is expected to more than offset these efficiency gains. This persistent demand growth underscores the continued importance of oil in the global energy mix for decades to come, even as the world increasingly embraces renewable alternatives.

Sources: EIA, IEA, OPEC

Industry Insights, Advanced Technologies & JH Partner Companies

JH Energy remains at the forefront of industry innovation through strategic partnerships with leading technology providers and energy service companies. These collaborations enable us to implement cutting-edge solutions across our operations while maintaining our commitment to efficiency, sustainability, and value creation.

Technological Innovation in Action

Our operational excellence is driven by implementing advanced technologies that optimize production and minimize environmental impact:

- Nano Gas-Liquid Mixed Displacement Technology: Enhancing oil recovery rates by up to 47%, significantly above industry averages

- AI-Powered Reservoir Modeling: Utilizing machine learning for precision drilling location selection and production optimization

- Digital Twin Operations: Creating virtual replicas of physical assets for real-time performance monitoring and predictive maintenance

- Advanced Carbon Capture Systems: Implementing next-generation technologies for emissions reduction and regulatory compliance

Key Technology Partnerships

JH Energy has established strategic relationships with technology leaders and service providers including:

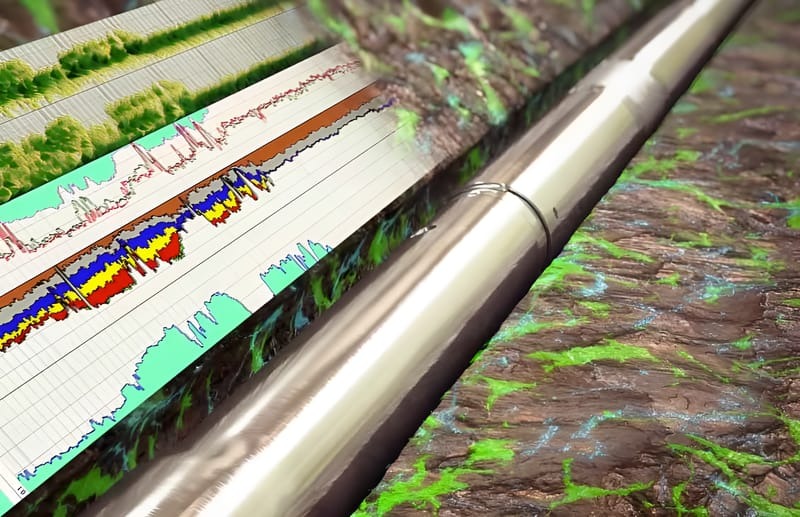

- Schlumberger: Integrated digital solutions for reservoir characterization and production optimization

- CNPC: Exploration & Advanced completion technologies and artificial lift systems

- Halliburton: Enhanced oil recovery techniques and well construction solutions

- Senogeo: Specialized geological assessment and reservoir analysis

- CNOOC: Drilling & CO2 Capture.

- Ultrado: Reservoir assessment & evaluation.

- Regional Service Providers: Local expertise supporting efficient operations across our diverse asset portfolio

Through these partnerships, we continuously evaluate and implement technologies that align with our strategic objectives, providing competitive advantages while reinforcing our position as a forward-thinking energy developer in today’s evolving market landscape.

Schlumberger Autonomous Drilling

AI In Digital Oil Field

AI In Oil And Gas Industry

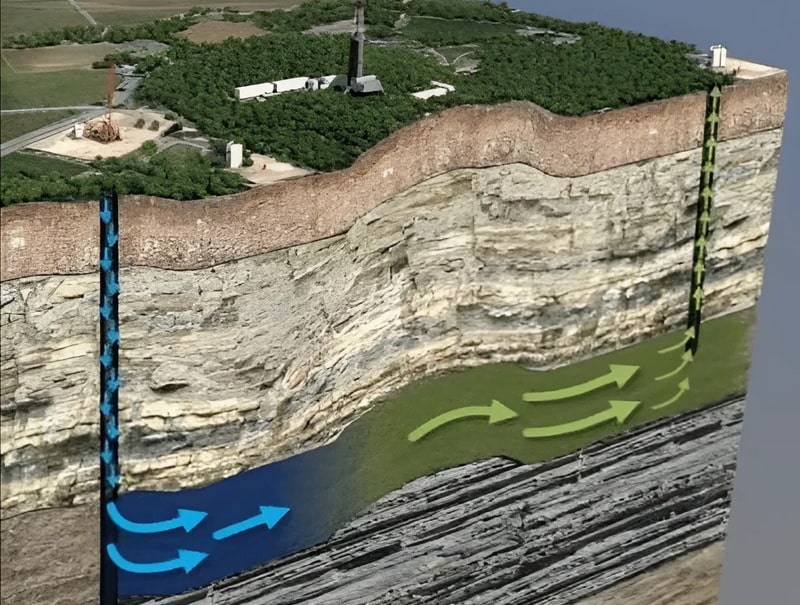

Multi-Pay Sands

Waterflood

Neutron Well Logging